Gold Bull Market Ready To Fire Off

The Conditions Are Similar To 70s That Brought 2,300% Increase in Gold Price

I personally went through the 70s business/economic cycle and was personally involved in it to a massive extent.

So, is it now time for the Gold Bull Market To Fire Off?

I had friends that bought up precious metals in mid 70s and made a fortune while I stuck with my Real Estate Holdings which amounted to a 13 million net worth by 1980 through my RE Investment Co. I then went on to lose most of it in the 80s with RE mortgage rates jumping overnight from 9% to 20% (Volcker) which completely destroyed the RE market.

So, in retrospect I should have bought up all the gold and silver I could have afforded.

Why Gold May Be On The Cusp Of Another Major Bull Market

Authored by Jesse Felder via TheFelderReport.com,

Last week, the Treasury Department revealed that the federal deficit hit $1.1 trillion in the first half of the fiscal year ending in March, $432 billion larger than the same period a year earlier.

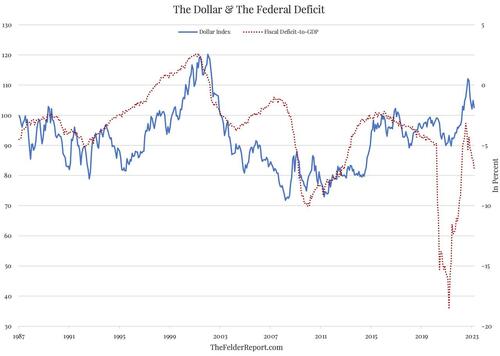

Moreover, most of this expansion came in the month of March, as spending rose 36% year-over-year (not in small part due to rapidly rising interest costs). Longer-term, there is a clear widening trend that began back in 2015 that appears to now have resumed after some pandemic-inspired gyrations. And, if history is any guide, this deteriorating fiscal trend should represent a structurally bearish influence for the dollar in the months and years to come.

Moreover, if history is any guide, the best protection against a deteriorating fiscal situation (mathematically guaranteed by rapidly growing social security and medicare spending) is gold.

The last time the deficit reversed from a narrowing trend and began a major widening trend, back in the early-2000’s, it coincided with a major top in the dollar index which evolved into a major bear market for the greenback (inverted in the chart below) that lasted roughly a decade.

This was one of the primary catalysts for a major bull market in the price of gold which rose from a low of $250 in 2001 to a high of nearly $2,000 a decade later.

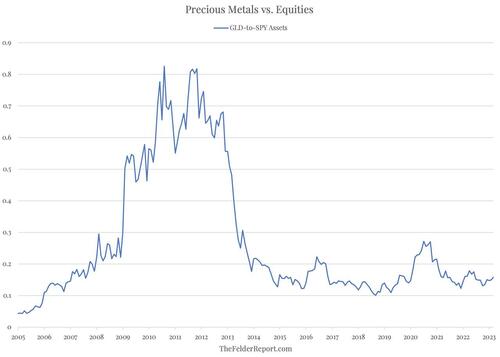

Currently, investors have little to no interest in owning gold (which is a bullish contrarian sign in my book).

As my friend Callum Thomas recently pointed out, assets in gold ETFs like GLD are a tiny fraction of those invested in equity ETFs like SPY.

However, there’s a good chance that the deteriorating fiscal situation will over time light a fire under investor appetites for precious metals relative to financial assets, just as it did two decades ago.

And that’s exactly the sort of thing that could power another major bull market for the precious metal.

Got gold?

Current events are setting up a situation unlike anything we’ve had before. We have the imminent loss of The PetroDollar position of the USA, along with the impending loss of the World Reserve Currency status of the US Dollar. These two factors could bring an enormous rise in value of precious metals.

7.14K subscribers

Urgent Alert: Secure Your Gold Now – Lynette Zang on Gold & Silver Prices In this crucial video, financial expert Lynette Zang shares her urgent warning on the importance of securing gold and silver in the current economic climate. With fluctuating prices and an uncertain future, now is the time to protect your wealth and ensure financial stability. Join us as Lynette Zang provides valuable insights on gold and silver prices, investment strategies, and the factors driving the market. Subscribe to our channel for more financial insights and expert advice on gold, silver, and other investment opportunities. Share your thoughts on the current market situation in the comments below, and let’s keep the conversation going! Educate my audience about silver gold,chris vermeulen, silver bullion, gold and silver news, silver news today, silver news, gold investment, silver price predictions, silver and gold, silver price, xrp, silver stacking, free market economics and the principles and benefits of individual liberty, limited government and sound money. These are America’s founding principles, guaranteed by the U.S. Thanks For Watching Our Video 🤗 Please, like, comment, subscribe, and ring the bell! EVERYTHING helps us grow!. Subscribe Here: 🙏 ====Disclaimer==== Information presented on this channel is for news, education, and entertainment purposes only is not intended as a solicitation of the sale or purchase of securities or investment strategies or a substitute for professional investment advice. #gold #goldpricetoday #lynettezang Thanks for watching the video