Create a stable financial future and protect your retirement by investing in a self-directed gold IRA. Noble Gold Investments gives you the opportunity to buy IRA-approved physical gold bars and gold coins in a gold-backed IRA.

Secure Your Future With A Gold IRA

Download Your FREE Gold IRA Investment Guide

Investments In Precious Metals vs Investments In The Stock Market

Protect Your Retirement By Investing In a Self-Directed Gold IRA

Secure Your Future With A Gold IRA

Create a stable financial future and protect your retirement by investing in a self-directed gold IRA. Noble Gold Investments gives you the opportunity to buy IRA-approved physical gold bars and gold coins in a gold-backed IRA. We make opening a gold IRA account a painless process. Our experts are standing by to help with everything including account creation, funding your account, assisting with an IRA rollover, and even educating you on how to buy gold in an IRA. Click the button below to get started today.

Downlod The Guide Here

What Is A Gold IRA?

A self-directed gold IRA (Individual Retirement Account) allows you to invest in physical gold, and serves as a good hedge against inflation since gold prices generally move in the opposite direction of paper assets.

You can also defer your tax payments, or even skip paying tax on capital gains. Contact our team today to learn more about a gold IRA rollover.

Why Invest In A Gold IRA?

Investing in a gold IRA is a great way to add diversification to your retirement portfolio for a few key reasons. First, when markets are down and paper assets are losing value, gold investments will typically increase in value. However, when markets are up, gold still tends to increase in value. In fact, gold is up more than 400% over the last 20 years. In addition, unlike stocks, bonds, and foreign currencies, gold is a physical asset that you can own. So when you are buying physical gold with an IRA you’re saving for retirement with assets you can hold.

Diversification

Tax efficient

Gold IRAs are one of the most tax efficient investment options available. Our experts can advise you further on how to get your tax breaks.

Stability

Gold has historically been a stable asset, increasing in value over time despite market fluctuations.

Global currency

Gold is the only currency that’s accepted around the world.

No counter-party risk

Unlike company stock, you don’t run the risk of gold going bankrupt.

Emerging industrial uses

Gold is currently being used in treating chronic diseases like cancer, making phones or computers, and producing oxygen in Mars.

Limited supply

Gold is rarer than diamonds. All the supply in the world can only fill two olympic-sized pools.

Gold Is A Great Hedge Against Inflation

Typically, when the value of the dollar declines, the value of gold increases. The money you invest in gold today would increase in value after a few years, giving you the opportunity to grow your net worth. Contact us today to learn more about opening a gold IRA account with Noble Gold.

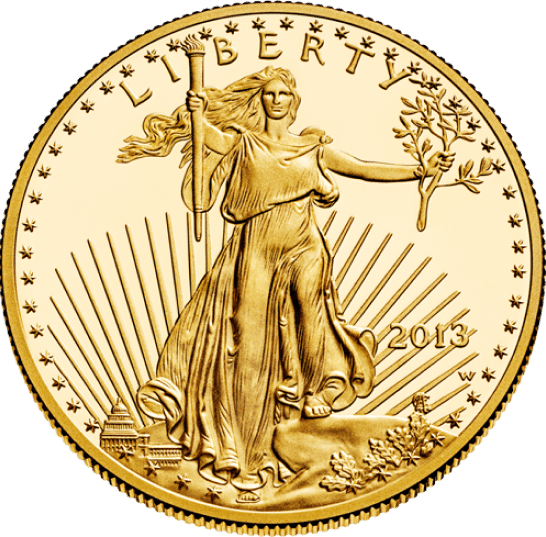

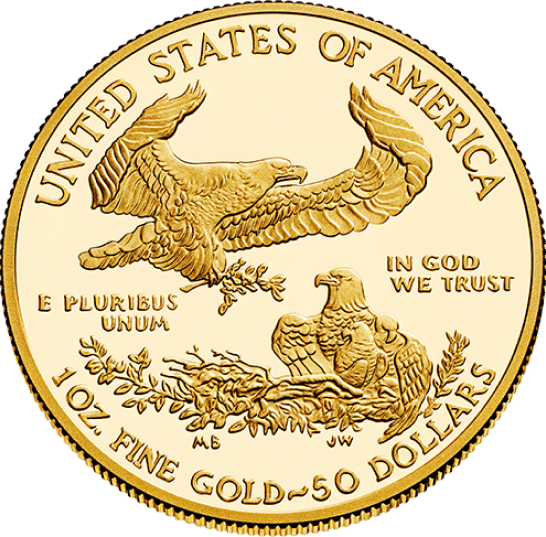

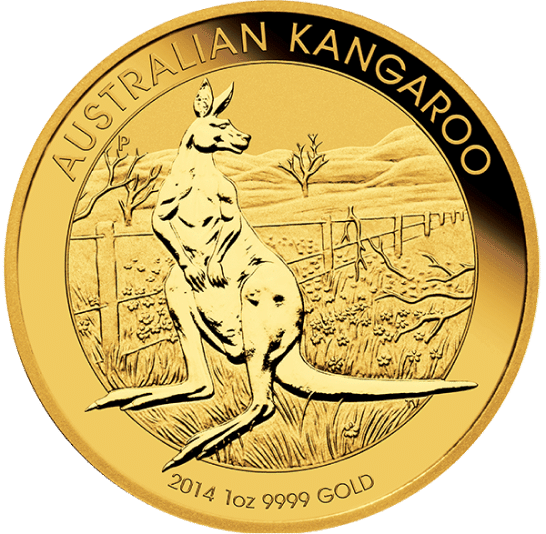

Purity Standards For IRA Gold

- Gold investments must be .9950 (24 karats) pure

- Gold bullion bars should be fabricated by NYMEX, COMEX, or any other ISO 9000 approved refiner.

- Proof gold coins should be presented with a certificate of authenticity and must be in their original mint packaging.

- All gold bullion must be in an uncirculated, first-rate condition.

Gold IRA vs Taxes

When you acquire gold through a Roth IRA (a Gold Roth IRA), you pay taxes only on your contributions, not on the gains. With traditional IRA, you can defer paying your taxes until you liquidate so you can use that money to invest in something else. Investing in gold-backed IRAs has become increasingly popular, especially since the crash in 2008/2009. Many investors that watched their retirements disappear before their eyes vowed to protect themselves from the next market crash by buying physical gold in an IRA.

So unlike other tax-advantaged investments, a gold IRA also can help hedge against any downturns in traditional markets. If you’re interested in learning more about the advantages of a gold IRA retirement plan, how to buy gold in an IRA account, converting your 401k to a gold IRA, or anything else at all about buying physical gold and/or holding it in an IRA, our team is here to help. Call us today at (877) 646-5347 to speak to a member of our team or send us an email to schedule a time to speak.

Keep your investments secure

IRS Approved Gold Coins

Not all gold is IRA-approved gold, so it’s important to work with a well-reviewed gold IRA company like Noble Gold Investments when opening a gold IRA account. Our team is standing by to answer any questions you may have about opening a gold IRA, rolling over an existing IRA or 401k, or any questions you may have about investing in physical gold. You can invest in the following gold coins for your gold-backed IRA. One ounce, one half, one quarter, and one tenth ounce gold coins are allowed by the Internal Revenue Service.